Holistic Wellness:

Balancing Finances and Mental Health as a College Student

Collaborative Post

Navigating the college years can be challenging, particularly when it comes to managing finances while maintaining mental health.

For many students, the pressure of expenses, loans, and living costs can lead to stress, anxiety, and even feelings of burnout.

However, with practical strategies and supportive resources, it’s possible to stay financially afloat while preserving your well-being.

Here are some actionable tips to help balance finances and mental health as a college student.

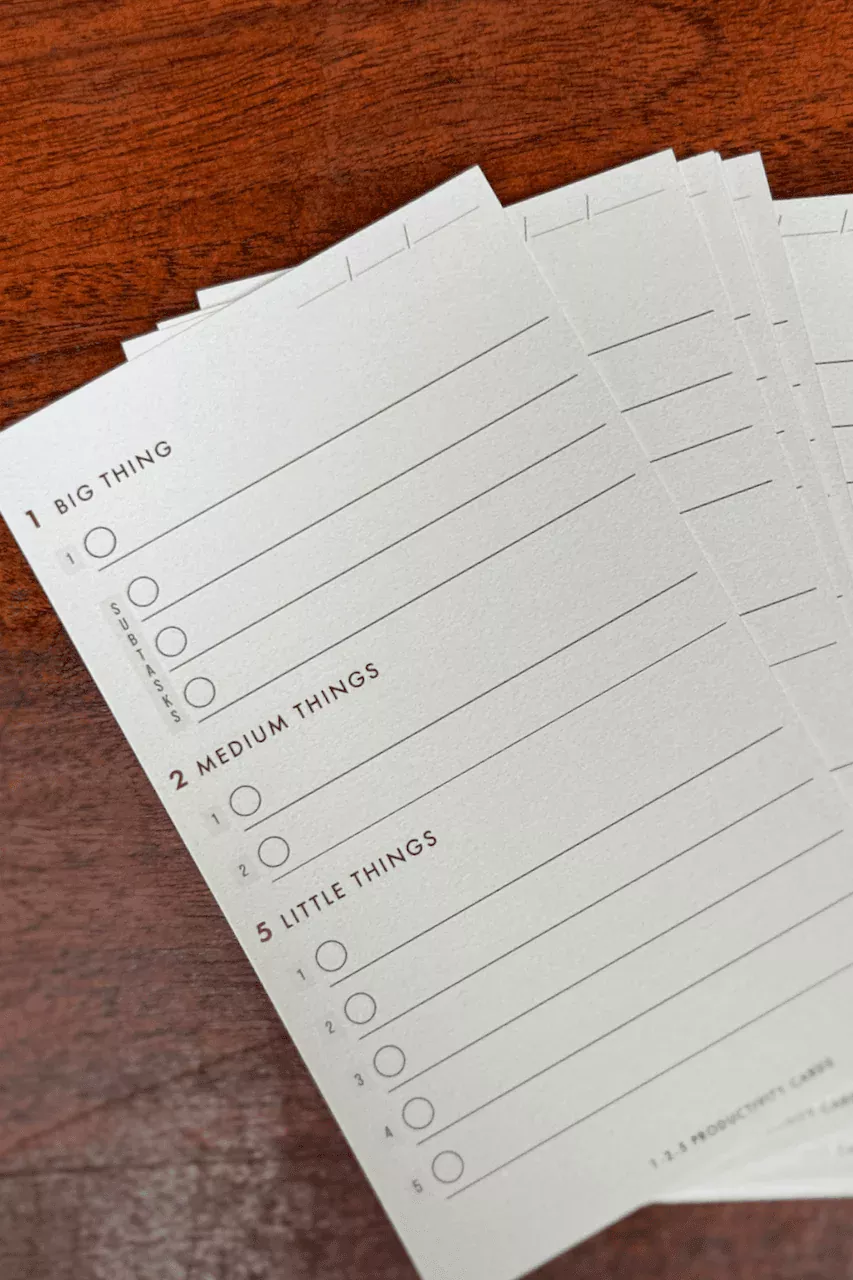

#1. Set Up a Realistic Budget for Peace of Mind

Establishing a realistic budget is a foundational step to financial stability and can significantly alleviate stress.

Start by listing out essential expenses tuition, books, housing, and food and then account for any extra costs like entertainment, transportation, and occasional treats. Be honest with yourself about spending habits and track your monthly expenses to identify areas where you might be able to save.

Apps like Mint or YNAB (You Need A Budget) make it easy to keep tabs on spending, alerting you when you’re nearing your budget limits.

Seeing a clear picture of your finances often reduces the anxiety that comes with uncertainty, helping you feel more in control of your money and your mental well-being.

#2. Evaluate Options for Student Loan Refinancing

Student loans are a significant source of financial strain for college students.

If you’re feeling overwhelmed by monthly payments or interest rates, consider refinancing student loans as a way to potentially lower your costs.

Refinancing involves replacing your current loan(s) with a new one at a different interest rate, which can reduce your monthly payments and save you money in the long term.

Before refinancing, research the various lenders and terms available. Refinancing may not be the best option for everyone, especially if you have federal loans with flexible repayment options.

However, for students with higher-interest private loans, it can be a valuable way to reduce financial pressure, making monthly payments more manageable and freeing up mental space to focus on other priorities.

#3. Manage Stress with the Help of Mental Health Resources

The financial stress of college can often lead to anxiety or even depression, particularly when juggling academics, work, and social obligations.

Seeking support from professionals can make a substantial difference. Many colleges provide free or discounted counseling services for students, and numerous anxiety therapists in New York and other regions specialize in helping young adults cope with stressors related to finances, academic pressure, and life changes.

For students experiencing financial anxiety, therapy can provide tools for managing stress and developing healthier coping mechanisms.

If visiting in person isn’t feasible, online therapy platforms like BetterHelp and Talkspace offer virtual sessions with anxiety therapists who can help guide students through financial stress and other mental health challenges in a convenient, accessible way.

#4. Balance Work and Study with Your Mental Health in Mind

Taking on a part-time job is a common way for college students to supplement their income, but it’s essential to strike a balance between work, academics, and rest.

Overworking can lead to burnout, impacting both grades and mental health. When considering a job, choose one that aligns with your academic schedule and allows time for self-care.

Look for on-campus opportunities, which often accommodate students' academic needs. If off-campus work is your only option, communicate your class and study schedule to ensure you’re not stretched too thin.

Balancing work and study allows you to earn extra income without sacrificing your mental and physical well-being.

#5. Develop Financial Literacy to Make Informed Decisions

Building financial literacy as a college student is one of the best ways to reduce stress around money management.

Understanding basics like interest rates, credit scores, and the impact of debt can empower you to make informed financial decisions. Many universities offer workshops or courses on financial literacy, and there are plenty of free online resources to help you get started.

Books like “Your Money or Your Life” by Vicki Robin and Joe Dominguez provide practical insights on personal finance, while podcasts like “Afford Anything” cover topics relevant to college students looking to manage money responsibly.

Financial literacy can make decisions about student loans, credit cards, and budgeting far less intimidating, boosting your confidence and reducing money-related anxiety.

#6. Practice Self-Care and Seek Social Support

Mental health and financial health are closely intertwined, and it’s important to take care of both.

Setting aside time for self-care whether that’s exercising, spending time with friends, or engaging in a hobby can relieve some of the pressure that comes with financial stress. Social support is also key - talking to friends, family, or trusted peers about financial concerns can help you feel less isolated.

Joining student groups or networks focused on wellness and financial literacy can provide community and support.

When money gets tight, and stress levels rise, having people who understand and offer advice can make a significant difference in maintaining balance.

#7. Use Financial Aid Wisely and Apply for Scholarships

Most students have access to financial aid or scholarship opportunities that can help cover tuition and other expenses.

Maximize your financial aid by carefully reading through each award’s terms and considering all available options, including merit-based scholarships, work-study programs, and grants.

Scholarships are particularly helpful because they don’t need to be repaid, offering a way to alleviate financial burdens without adding more debt.

There are many scholarships geared specifically toward students facing financial or mental health challenges. Websites like Fastweb and Going Merry can help you find and apply for scholarships that align with your background and needs.

Conclusion

Managing finances as a college student can feel overwhelming, but with thoughtful strategies and support, you can maintain both financial stability and mental health.

By setting realistic budgets, exploring options like refinancing student loans, and seeking help from anxiety therapists, students can navigate college with confidence.

A balanced approach to finances and mental well-being not only makes college life manageable but also builds skills that will benefit you well beyond graduation.

—End of collaborative post—

✨ New Series: How to Become an Early Riser

- Discover key methods to make early rising a habit

- How to wake up early + energized every morning

- Morning routines for health + success

Free self-development courses

👇

Tap on any of the courses below to start learning how to:

- boost your productivity (with GTD),

- get focused (with Deep Work),

- or learn the art of influencing others (with the How to Win Friends & Influence People course.)

All for free.

👇

Free life guides

👇

Best-selling Self-development courses by Dean Bokhari

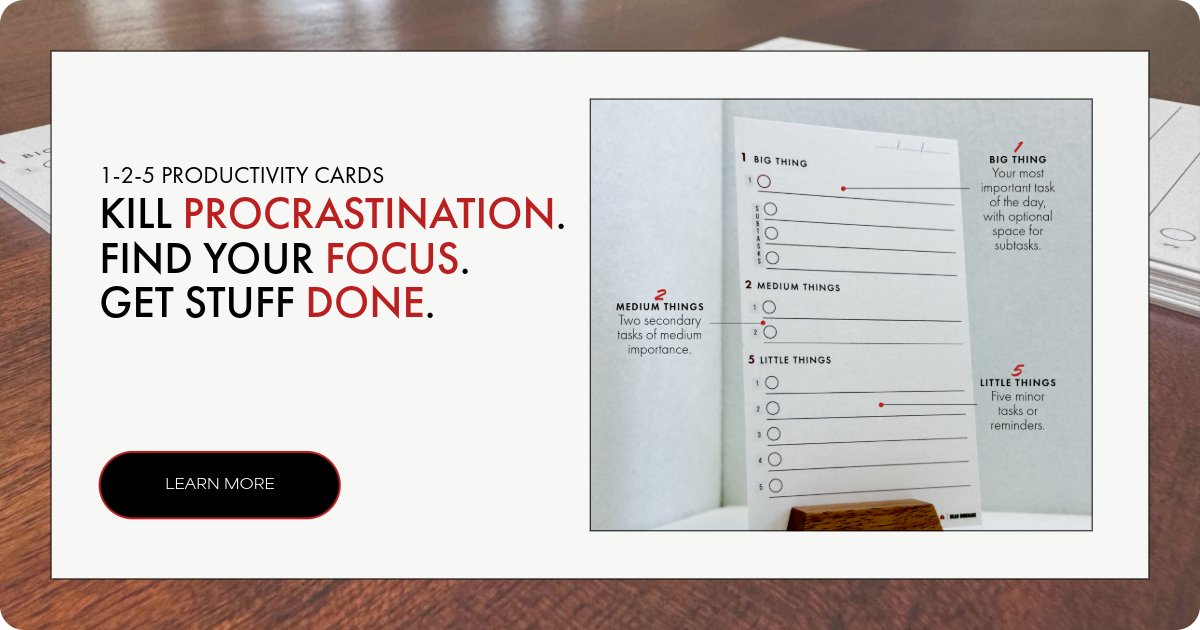

Kill procrastination.

|

Get stuff done.

|

Get motivated.

|

Connect with anyone.

|

freshly pressed:

Top Audiobooks narrated by Dean Bokhari on audible | |

Book summaries

- The Power of Habit by Charles Duhigg

- 12 Rules for Life by Jordan B. Peterson

- Presence by Amy Cuddy

- Leaders Eat Last by Simon Sinek

- The ONE Thing by Gary Keller, Jay Pasan

- Deep Work by Cal Newport