These

Steps Will Help you to Improve your Financial Future

Collaborative Post

Financial fitness and general well-being are all about feeling as though you are in control of your financial position. It involves you having the confidence and knowledge you need to make the most out of the money you have daily. It also allows you to take control of any events that may be unplanned. This may be easier said than done, but at the end of the day, it is a critical part of making sure that you are always safeguarding your future as much as possible.

Source: Pexels

Plan your Spending

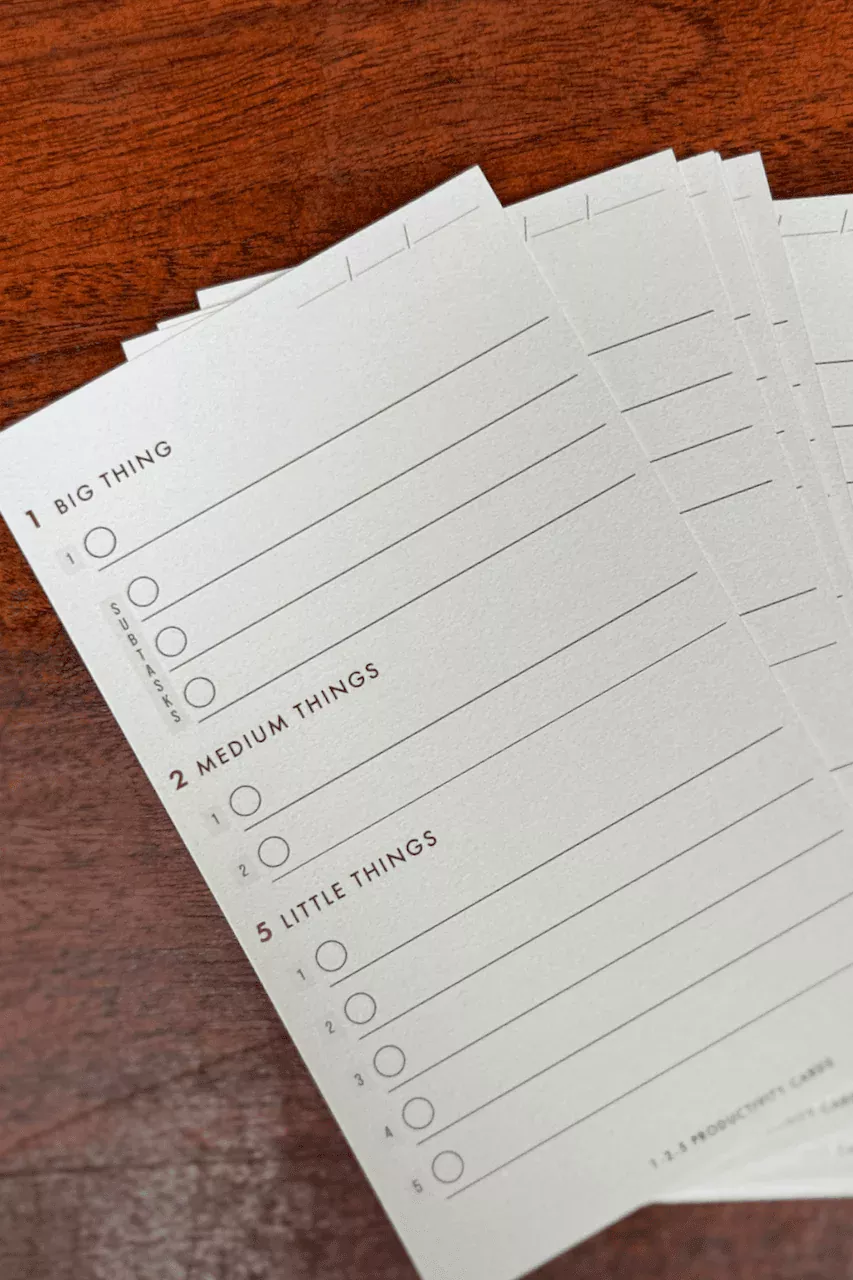

One of the first things you need to do is try and plan your spending as much as possible. You need to try and take control of what you need to spend and what you want to spend. Your budget should include all of the essentials but at the same time, it should also include some of the things you enjoy. A budget planner can be a good way for you to make the right changes, so be sure to keep that in mind as it could make a major difference to your home. It’s also so important that you set time to one side so you can forecast your spending regularly. You can do this every time you get paid if you want and there is a huge range of apps that you can use to help kickstart the process.

Keep Track of Spending

You also need to try and keep track of spending where you can. Creating a budget is easy but sticking to one can be hard. Monitoring the expenses you have is so important. Again, you can use apps to try and help with this but ultimately it comes down to you knowing how much you have going out and how much you have coming in. Be mindful of your expenses increasing so you can stay in control of everything too, as this is often the best way for you to safeguard yourself against any price increases that may affect you later down the line. If you can, make investments and keep this in mind when spending. Explore equity vs. cash compensation as well, so you can get the result you want out of your efforts.

Be Wise with Spending

You also need to try and be wise with your spending. No matter how small your budget might be, you do need to make sure that you do not overspend. You need to know your limits and you also need to use the money you have wisely. If you don’t then you may end up feeling guilty and this is the last thing you need. You also need to focus on spending your money on essentials, and things that you get value from. If you can spend money on new clothes or going out with friends, then this is fine as you enjoy it. Include it in your budget so you do not go on to regret it at a later date.

Avoid Borrowing

You also need to try and avoid borrowing if you can, especially for essential expenses. Borrowing money isn’t always a bad thing, and it’s important to know this. When you borrow appropriately and when you use your money wisely you will soon find that it is possible for you to greatly improve your financial situation. If you take out a mortgage to buy a house for example then this can help you to be better off in the future, as the house could well increase in value. So long as you can keep up with the payments, you should be fine. If you are borrowing money for daily essentials such as food or to pay your bills then this can lead to even bigger problems later down the line. This is especially the case if you are using short-term credit to try and navigate certain situations.

Save Money

When the time comes for you to budget, you need to try and save money too. Make sure that you are putting some money aside each month so you can gradually build your savings. If you do this then you will soon find that it is easier for you to get the result you want out of your business. The key here is for you to make it into a habit. Make goals and put them to work by trying to achieve tangible things. If you can do this then you will soon find that you can get the result you want out of your efforts and that you can also really cut back on the amount of stress you put yourself under when things go wrong. If you can remember this, it’ll help you out.

—End of collaborative post—

✨ New Series: How to Become an Early Riser

- Discover key methods to make early rising a habit

- How to wake up early + energized every morning

- Morning routines for health + success

Free self-development courses

👇

Tap on any of the courses below to start learning how to:

- boost your productivity (with GTD),

- get focused (with Deep Work),

- or learn the art of influencing others (with the How to Win Friends & Influence People course.)

All for free.

👇

Free life guides

👇

Best-selling Self-development courses by Dean Bokhari

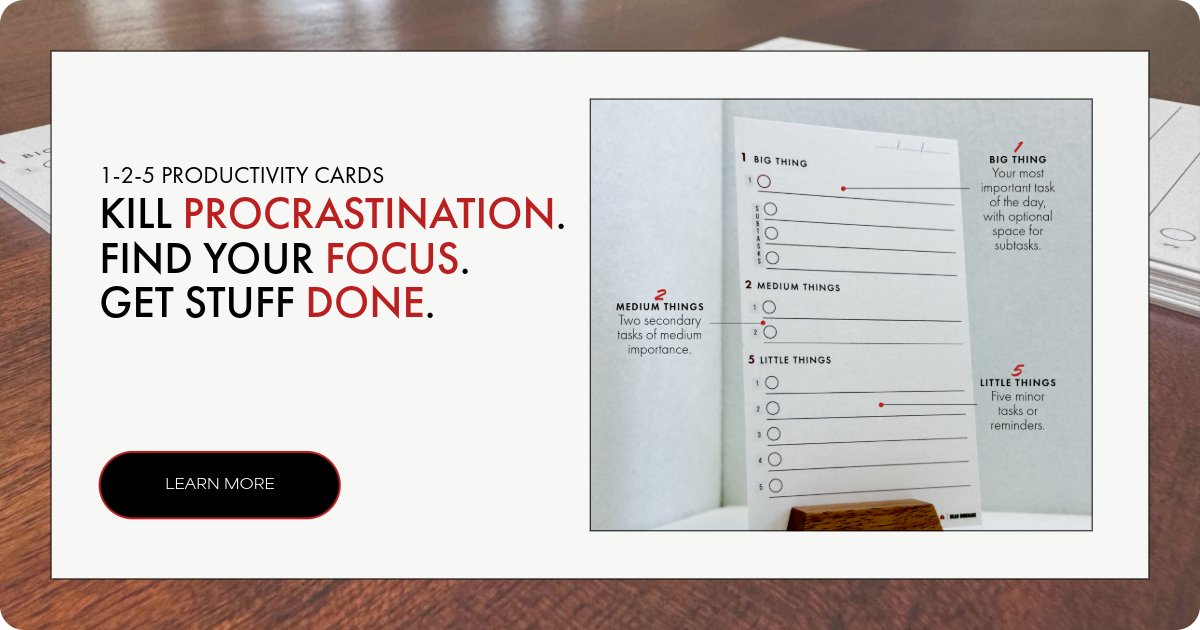

Kill procrastination.

|

Get stuff done.

|

Get motivated.

|

Connect with anyone.

|

freshly pressed:

Top Audiobooks narrated by Dean Bokhari on audible | |

Book summaries

- The Power of Habit by Charles Duhigg

- 12 Rules for Life by Jordan B. Peterson

- Presence by Amy Cuddy

- Leaders Eat Last by Simon Sinek

- The ONE Thing by Gary Keller, Jay Pasan

- Deep Work by Cal Newport